Updated: 9/11/18 | September 11th, 2018

For as long as I’ve been traveling the world, I’ve used World Nomads as my travel insurance provider. Though I’ve written about travel insurance in the past, I’ve never properly reviewed World Nomads as a company.

So without further ado here is a review of World Nomad’s Travel Insurance.

Who are World Nomads?

World Nomads is a travel insurance company based in Australia. It was founded in 2002 by Simon Monk, a traveler who wanted to address the three key concerns: freedom, safety, and connection. Insurance was a market fraught with fraud. As a bunch of passionate travelers ourselves, he figured they had a fair idea of what travelers needed and wanted. They people from over 150 countries, with medical and evacuation cover, 24-hour emergency assistance and cover for a large range of adventure activities.

I originally found World Nomads via Lonely Planet but they are also recommended by National Geographic and Rough Guides. I trust those companies so I bought the insurance and have never looked back!

World Nomads is the perfect insurance company for backpackers and travelers. It’s meant for people who are always on the move, and it covers all the essentials you want in travel insurance. I love the management of the company, its competitive prices, its social giving program, and its company ethos of being insurance for travelers by travelers. It is a company a world apart!

What’s included in World Nomads Insurance Policies?

(The prices in the left column are for the Standard Plan, while the prices in the right column are for the Explorer Plan, which offers higher coverage limits.)

MEDICAL COVERAGE

World Nomads provides up to $100,000 USD in coverage, though its more expensive policies will cover you for higher amounts. High coverage limits can be important if you’re doing really crazy activities that might cause serious injury. Or if you get really, really, really sick. (That said, I find $100,000 in coverage is more than enough for what I need).

Its policies also provide coverage for medical expenses and those related to medical evacuation or repatriation if you’re accidentally injured. If you are hiking in the woods and you break your leg, your policy should cover your evacuation to the hospital — and World Nomads does, if the emergency evacuation is ordered by a physician who certifies that the severity of your accidental injury or sickness warrants it.

Emergency dental treatment

World Nomads also covers emergency dental treatment for accidental injuries that occur during the trip.

NON-MEDICAL EMERGENCY EVACUATION

World Nomads also offers coverage for transportation expenses in case there is civil or political unrest in the country you’re visiting. This also applies to natural disasters, or if you’re expelled from a country. NOTE: If you’re a US citizen, certain states are not covered under this. You’ll have to check your certificate.

ACCIDENTAL DEATH AND DISMEMBERMENT INSURANCE

In case the worst happens, your World Nomads plan pays a lump sum to your beneficiary, such as a family member. These policies also pay out if you lose your eyesight or a hand, foot, or limb, etc. on your trip. Moreover, they cover the cost of repatriating your body (i.e., sending your body home).

LOST OR STOLEN GOODS

This coverage reimburses you for baggage and personal belongings that are lost, stolen, or damaged during the trip. Some plans also reimburse you for extra expenses if your baggage is delayed for more than a certain period, such as 12 hours.

TRIP CANCELLATION, INTERRUPTION, OR DELAY

Trip cancellation insurance reimburses you for prepaid expenses if the tour operator goes out of business, you have to cancel the trip because you or a family member gets sick or injured, or there is a death in the family, bad weather, or a natural disaster.

Trip interruption insurance covers you if you have to interrupt a vacation because you get sick or injured, or have to get back home due to a death in the family.

Trip delay coverage covers your expenses if you’re delayed during a trip, such as when a flight gets canceled because of bad weather. Coverage is for additional expenses, on a one-time basis, if you are delayed en route to or from the trip for six or more hours due to a defined hazard (as explained in the certificate or policy).

World Nomads covers all three!

ONE CALL: 24-HOUR ASSISTANCE SERVICES

World Nomads also uses a 24-hour service called One Call to provide help, advice, and referrals for medical emergencies. The service will help you locate local physicians, dentists, or medical facilities. They can also arrange and pay for appropriate transportation, including an escort, if required, to a suitable hospital, treatment facility, or home.

What’s Not Covered

If you’re reckless, you probably won’t be covered. Here’s a list:

- Accidents sustained while participating in extreme adventure activities such as hang gliding, paragliding, or bungee jumping unless you pay extra.

- Alcohol- or drug-related incidents.

- Carelessness in handling your possessions and baggage.

- You won’t get reimbursed if the problem happened because you were reckless (how “reckless” is defined is a matter up to each company).

- Pre-existing conditions or general check-ups. For example, if you have diabetes and need to buy more insulin, you won’t be covered. If you want to go see a doctor for a general check-up, you aren’t covered either.

- Cash

- Your theft coverage won’t cover you if you left something in plain sight or unattended.

- If civil unrest makes your destination unsafe but your government hasn’t called for an evacuation, you’re probably out of luck too.

Pros and Cons of World Nomads

Pros: Affordable prices

Affordable prices

Great coverage

You can extend your policy online

You can make a claim online while on the road

24/7 service

Fast service

Book on the road

Cons:

It doesn’t cover people over 70

Its online system can be a little confusing to figure out

The Explorer plan covers up to $3000 total and a per article limit of $1500 on electronics and personal items.

My Experience Using World Nomads

In addition to buying a policy online (even if you’re already traveling), you can also indefinitely extend your insurance policy online. Moreover, as someone who is always on the road and bouncing from country to country, the ability to just take photos of all my documents and receipts and upload them is hugely beneficial! Plus, the whole claims process can be done online.

I’ve had to use World Nomads’ services twice. The first time was when South African Airlines lost my luggage on the way back from Africa. Knowing I had coverage, I called World Nomads to ask what I could do. They told me that I would have to wait to see if the airline would reimburse me first. If the airline would not reimburse me within 90 days, they would. (Travel insurance is about making you whole, not making sure you make a profit.)

The process was relatively easy. I filled out an online form listing what I had in my bag and its estimated value. I submitted the documents that showed I had requested a reimbursement from the airline. Then I waited.

Luckily, the airline paid me and I didn’t need World Nomads, but I learned through this process that if you have all your documents and proof, World Nomads makes submitting a claim very easy.

Another time, in Argentina, I was suffering from anxiety and worried that it was something more. It felt like someone was stomping on my chest. I logged into the portal, got the call center number, and called the hotline. They took my information and symptoms and gave me a list of emergency doctors that they recommended. The One Call system was helpful, quick, and got me a doctor right away. I was very happy with the service and know that if something really does go wrong, they act quickly!

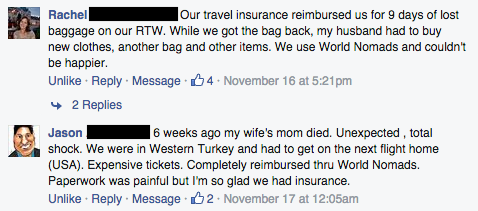

While I have never had to make a claim that required reimbursement, a number of readers have. Here is their feedback on the process:

How to make an insurance claim

All insurance companies have terrible online reviews. This is usually because the traveler didn’t read the wording of the policy and assumed something was covered when it wasn’t. It is very, very important that you read the requirements for making a claim. Generally speaking, if it’s something a sane, sober person wouldn’t do, you’re probably not going to get reimbursed!

For that matter, you should read your whole policy. Seriously. It’s terrible, but reading it is the only way you will know what is and is not covered! If you have questions, call World Nomads. They are very helpful in explaining their policies! Local numbers are on their website!

Also, keep these two points in mind:

- Document all your stuff. Travel insurance companies follow a simple rule: no proof, no reimbursement. If you want to make a claim, you’ll need to prove (a) that you bought something (keep all your purchase receipts if you have them), (b) that it was there with you, and (c) that it was stolen. To that end before I go on any trip, I take a photo of my bag and its contents before I leave so I have time-stamped photo with me and my stuff. If anything is stolen, be sure you file a police report too as companies will ask for that!

- Document your illness. If you get sick, keep all your paperwork and receipts. The more information and documents you have, the easier it will be to get reimbursed!

Travel insurance only costs a few dollars a day (your policy price will vary by length and where you are from) and, for that price, it’s a no brainer. While there are many travel insurance companies out there that are cheaper, the devil is always in the fine print and they don’t have low coverage limits, don’t let you renew on the road, and have terrible reimbursement rates. Insurance is something you get what you pay for. Pay an extra few cents a day to be covered. A lot of people don’t buy travel insurance when they travel because they think “What can happen to me?” And that’s the point of insurance. No one is Superman and you’re healthy until your not. Insurance covers trip delays and problems, accidents, health care, theft, and a bunch of other things. I’ve been on the road ten years and I can tell you that accidents will happen. And it’s good to always have a company that has your back. I’ve never once regretted my decision to get insurance with World Nomads.

You can use the widget below to look up the travel insurance policy that is right for you (or just click here to go to their website directly:

The post World Nomads Travel Insurance Review: What’s Included & What’s Not appeared first on Nomadic Matt's Travel Site.

from Nomadic Matt's Travel Site https://ift.tt/2p0J2UY

No comments:

Post a Comment